The board of Principal Financial Group, Inc. (NASDAQ:PFG) has announced that it will be paying its dividend of $0.67 on the 20th of December, an increased payment from last year's comparable dividend. This will take the annual payment to 3.7% of the stock price, which is above what most companies in the industry pay.

See our latest analysis for Principal Financial Group

Principal Financial Group's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last dividend was quite easily covered by Principal Financial Group's earnings. This means that a large portion of its earnings are being retained to grow the business.

Over the next year, EPS is forecast to expand by 30.8%. If the dividend continues along recent trends, we estimate the payout ratio will be 34%, which is in the range that makes us comfortable with the sustainability of the dividend.

Principal Financial Group Has A Solid Track Record

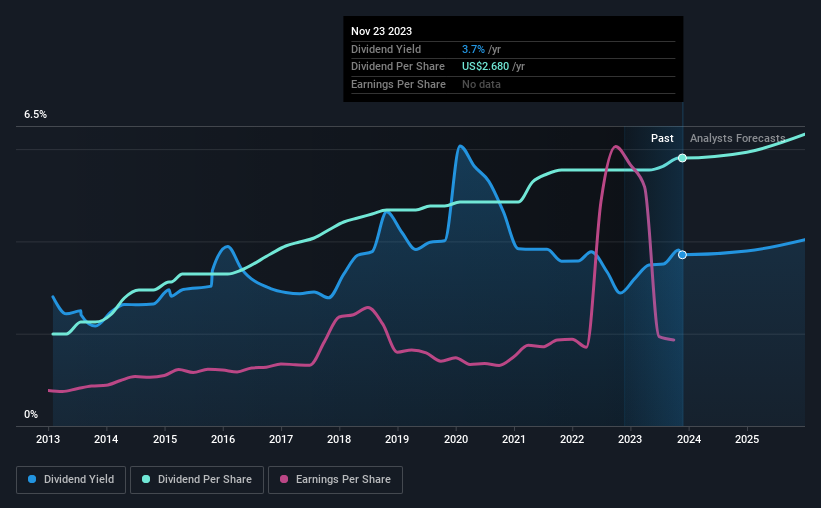

The company has a sustained record of paying dividends with very little fluctuation. Since 2013, the annual payment back then was $0.92, compared to the most recent full-year payment of $2.68. This works out to be a compound annual growth rate (CAGR) of approximately 11% a year over that time. So, dividends have been growing pretty quickly, and even more impressively, they haven't experienced any notable falls during this period.

Dividend Growth May Be Hard To Achieve

The company's investors will be pleased to have been receiving dividend income for some time. Let's not jump to conclusions as things might not be as good as they appear on the surface. Over the past five years, it looks as though Principal Financial Group's EPS has declined at around 3.0% a year. If earnings continue declining, the company may have to make the difficult choice of reducing the dividend or even stopping it completely - the opposite of dividend growth. Earnings are forecast to grow over the next 12 months and if that happens we could still be a little bit cautious until it becomes a pattern.

Our Thoughts On Principal Financial Group's Dividend

In summary, it's great to see that the company can raise the dividend and keep it in a sustainable range. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 1 warning sign for Principal Financial Group that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're helping make it simple.

Find out whether Principal Financial Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Principal Financial Group (NASDAQ:PFG) Will Pay A Larger Dividend Than Last Year At $0.67 - Simply Wall St

Read More

Tidak ada komentar:

Posting Komentar